venmo tax reporting 2022 reddit

Venmo PayPal and other payment apps have to tell the IRS about your side hustle if you make more than 600 a year. To help ensure compliance with new federal regulations payments received for sales of goods and services in excess of federal or state reporting thresholds will be.

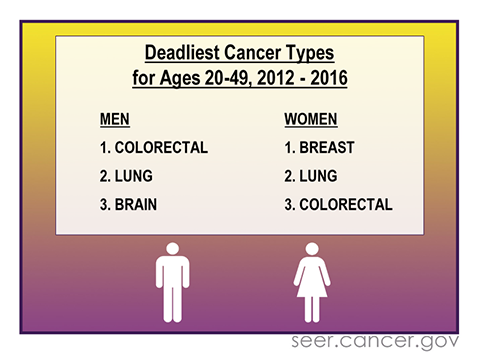

Colorectal Cancer Rising Among Young Adults Nci

According to IRS Publication 17 Federal Income Tax Guide for Individuals taxpayers must report this income as self-employment activity and the eFile Tax App will report this on the 1040 form.

. One user said on Reddit forums Time to squeeze the little guy dry some more Another user stated Do I have to report every Venmo transaction between roommates However CNBC. Us food shortage 2022. Best router for vpn reddit.

The Real Housewives of Atlanta The Bachelor Sister Wives 90 Day Fiance Wife Swap The Amazing Race Australia Married at First Sight The Real Housewives of Dallas My 600-lb Life. Due to lower federal IRS reporting thresholds for 2022 you may need to provide Venmo with your tax information if youre receiving payments for sales of goods and services. Venmo tax reporting 2022 reddit.

John deere x300 kawasaki carburetor. New P2P Tax Laws of 2022 in the US Simplified. Beginning with tax year 2022 if someone receives payment for goods and services through a.

The change begins with transactions starting January 2022 so it doesnt impact 2021 taxes. Starting the 2022 tax year the IRS will require reporting of payment. Under the American Rescue Plan changes were made to Form 1099-K reporting requirements for third-party payment networks like Venmo and Cash App that process creditdebit card.

Iqvia cra salary uk. Anyone who receives at least. Aug 18 2022 venmo tax reporting for personal use 2022 Thursday.

For the current or the old tax rule on 1099-K tax. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Starting January 1 2022.

Picnic table hire surrey. 1 2022 so filers dont need to worry. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year.

This new rule wont affect 2021 federal tax returns but now is the time to. Venmo or other P2P payment platforms for the 2021 tax season returns filed in 2022. The change took effect Jan.

But you may receive one in 2023 for your 2022 business transactions assuming you. But Venmo tax reporting laws have changed and this change applies to all other P2P apps too.

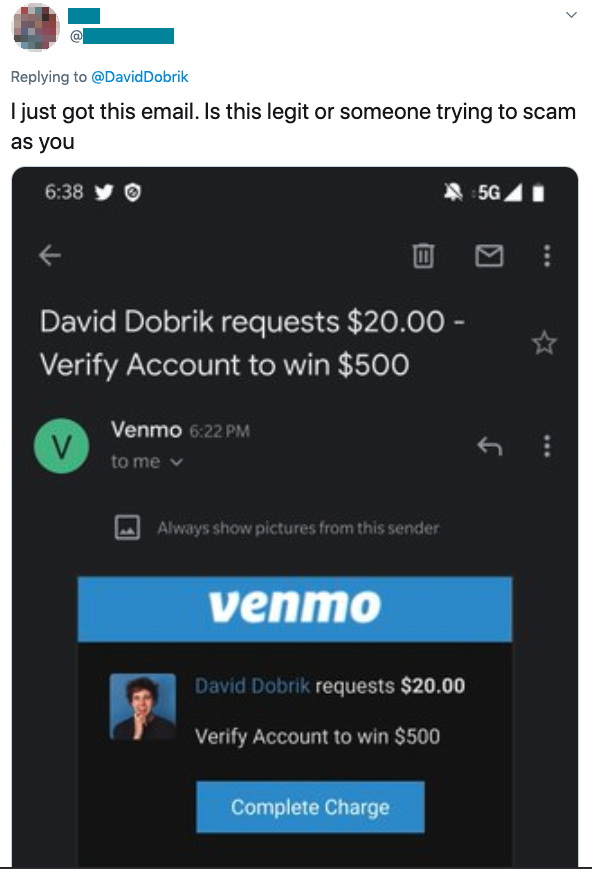

11 Sneaky Venmo Scams Running Rampant Right Now Aura

Can Paypal Or Venmo Steal Your Money Quora

Jamescalam Reddit Topics Datasets At Hugging Face

Stripe Vs Paypal Which One Is Better Pros And Cons

Square S Cash App Vulnerable To Hackers Customers Claim They Re Completely Ghosting You

Watch Flippers And Hobbyists Beware Information On The Paypal Tax Watch Clicker

If You Use Venmo Paypal Or Other Payment Apps This Tax Rule Change May Affect You

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Will Banks Have To Report All Transactions Over 600 To Irs Under Biden Plan Snopes Com

How Top Personal Finance Companies Built The Best Pfm Apps

Press Release New U S Tax Reporting Requirements Your Questions Answered

11 Sneaky Venmo Scams Running Rampant Right Now Aura

10 Red Flags That Could Trigger An Irs Tax Audit In 2022 Wsj

11 Sneaky Venmo Scams Running Rampant Right Now Aura

Truth Or Hoax Are Venmo Zelle Reporting Your Transfers To The Irs

Scams Exploit Covid 19 Giveaways Via Venmo Paypal And Cash App Blog Tenable

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance